New Delhi, March 30: Starting April 1, the National Payments Corporation of India (NPCI) will implement an interchange fee on merchant UPI (Unified Payments Interface) transactions. The fee will only apply to prepaid payment instrument (PPI) transactions made through UPI that exceed ₹2,000. The interchange fee varies between 0.5% to 1.1%, depending on the category of merchants. A cap is also applicable in certain categories.

It is important to note that this fee will not be charged on normal UPI payments, which are described as “bank account-to-bank account-based UPI payments.”

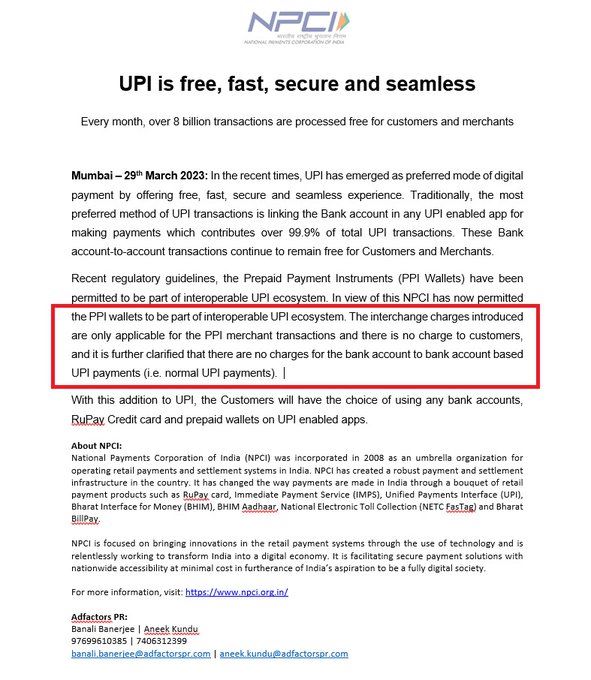

NPCI clarified in a recent notification that the interchange fee introduced will only be applicable to prepaid payment instruments used for merchant transactions, and normal UPI payments, which it called “bank account-to-bank account-based UPI payments,” will not be subject to any charges.

Support Independent Journalism? Keep us live.

Effective April 1, NPCI will impose varying interchange fees on merchant UPI transactions, depending on the transaction category. For instance, telecom, education, and utilities/post office categories will attract an interchange fee of 0.7%, while for supermarkets, the fee will be 0.9% of the transaction value. Insurance, government, mutual funds, and railways categories will be subject to a 1% interchange fee, fuel at 0.5%, and agriculture at 0.7%. The information was reported by CNBC TV-18.

The National Payments Corporation of India (NPCI) announced that a new fee will be charged only for merchant transactions made through prepaid payment instruments. The NPCI clarified that regular UPI payments, which are bank account-to-bank account based, will not be subject to any charges. The NPCI also stated that peer-to-peer (P2P) and peer-to-peer-merchant (P2PM) transactions will not be subject to interchange fees, while issuers of prepaid payment instruments will be required to pay a wallet-loading charge of 15 basis points for transactions above ₹2,000.

The pricing for these services will be reviewed by the NPCI before September 30, 2023. Last year, the Finance Ministry had tweeted that UPI is a digital public good and that there were no plans to impose charges on UPI transactions. The ministry’s statement came in response to a discussion paper issued by the Reserve Bank of India (RBI), which suggested that charges for UPI fund transfers could be similar to those for IMPS transactions.

Comments are closed.