SIM Deactivation Fraud: Know What the Expert Says

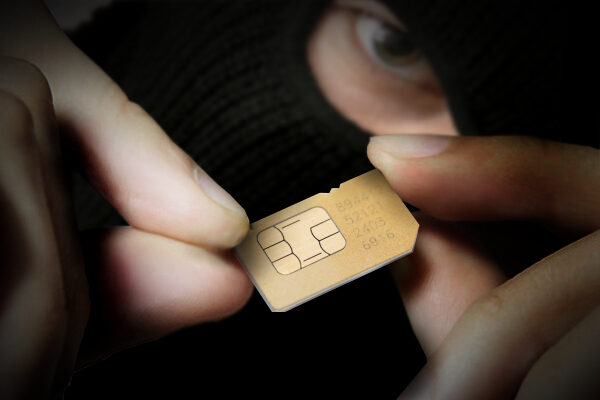

The fraud is known as SIM swapping, and it can be used to take over your financial accounts.

Insight Bureau: Your cellphone could provide a way for cybercriminals to access your financial accounts, how? Through your mobile number.

The fraud is known as SIM swapping, and it can be used to take over your financial accounts. SIM swapping relies on phone-based authentication. In a successful SIM swap scam, cybercriminals could hijack your cell phone number and use it to gain access to your sensitive personal data and accounts.

Here’s how it works. You might try to access one of your bank accounts that uses text-based two-factor authentication. That means you begin to access your account by entering your user name and password. Your bank then sends an access code to your cellphone for you to complete the log-in process.

But what if fraudsters are able to change the SIM card connected to your mobile number? That would give them control over that number — and they’d receive the access code to your account.

It’s a good idea to learn about of SIM card swapping. That way you can help protect yourself against this type of fraud — or recognize if you’ve become a victim.

Some of the indications that a person might be a victim to SIM swapping are mentioned below:

Unable to call or text is an obvious sign when a person is unable to make calls or message someone. Most likely it means that the fraudsters might have deactivated the SIM card.

Accessing accounts won’t be possible like the bank accounts in which case contacting the bank should be the first priority.

Getting notifications of your SIM card being activated somewhere else.

Support Independent Journalism? Keep us live.

Some ways to protect yourself from SIM card fraud:

Keep a tab on where you are entering your email details and personal details as these might be phishing attempts which will help these scammers to convince your bank or cell phone company that they are actually you.

Use authentication apps such as Google Authenticator which sends code for two-factor authentication to that app instead of your mobile phone. Also, make use of strong passwords and strong questions.

There are ways to use PIN codes as an added protection to your communications if your phone carrier allows it.

Here’s what the expert says:

Cyber crime expert Prashant Sahu has tweeted a video briefing the issues related to SIM swapping. It will help you to stay concerned about these frauds.

SIM Deactivation FRAUD :

This Common Small Mistake can put you in deep trouble . Your Bank Ac / FD / Mutual funds / Whatsapp / Gmail / Facebook etc will be hacked if u do this mistake . @dcpbbsr @dcp_cuttack @odiapolice @ajaya_ops @BinayakSahoo #Simdeactivation #CyberFraud pic.twitter.com/vGa5h1MF4h

— Prashant Sahu ?? (@suryanandannet) February 20, 2022

The government has also set a helpline number for the cyber fraud. If you are a victim of such frauds, you can dial 1930 and register your complain.

Comments are closed.