RBI Announcements Today: Key Features

RBI to keep repo rate, reverse repo rate unchanged at 4% and 3.35%

TNI Bureau: In the face of COVID-19 uncertainties and inflation anxieties, the RBI left the benchmark interest rate steady on Friday. The repo rate (lending rate) will remain unchanged at 4%, while the reverse repo rate (the rate at which the RBI borrows) will also remain unchanged at 3.35%. During the most recent MPC meeting in April 2021, the panel also kept rates unchanged.

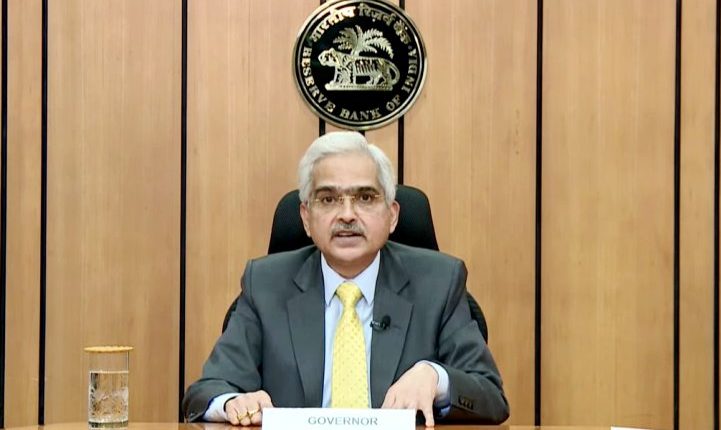

According to RBI Governor, Shaktikanta Das, ”Second wave has impaired the economic recovery but it has not snuffed it out.”

Support Independent Journalism? Keep us live.

The key points of RBI’s monetary policy are mentioned below.

- Repo rate was retained at 4%, indicating that the central bank’s dovish stance continues to help an economy battling for revival.

- The reverse repo rate (RBI’s borrowing rate) was retained at 3.35%.

- Because of the damage caused by Covid’s second wave, the growth projection for FY22 has been lowered to 9.5%.

- CPI inflation will be 5.1 percent in 2021-22, according to the MPC, with 5.2 percent in Q1, 5.4 percent in Q2, 4.7 percent in Q3, and 5.3 percent in Q4.

- On June 17, the central bank would purchase government securities worth Rs 40,000 crore.

- In Q2, a total of Rs 1.20 lakh crore worth of G-Secs would be purchased.

- The RBI will continue to operate in order to maintain stable liquidity management.

- A separate liquidity window of Rs 15,000 crore has been announced for the hospitality sector.

- India’s forex may have surpassed $600 billion milestone, according to reports.

Comments are closed.