▶️ Slabs and rates being changed across the board to benefit all tax-payers.

▶️ New structure to substantially reduce taxes of middle class and leave more money in their hands, boosting household consumption, savings and investment.

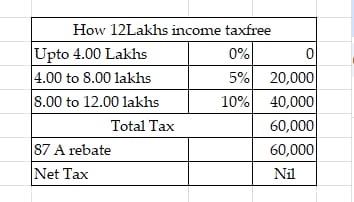

▶️ ‘Nil tax’ slab up to ₹12 lakh (₹12.75 lakh for salaried tax payers with standard deduction of ₹75,000).

Support Independent Journalism? Keep us live.

Steps to Claim a Tax Rebate Under Section 87A

Calculate your gross total income for the financial year.

Reduce your tax deductions for tax savings, investments, etc.

Arrive at your total income after reducing the tax deductions.

Declare your gross income and tax deductions in ITR.

Claim a tax rebate under section 87A if your total income does not exceed Rs 12 lakh under the new tax regime.

Comments are closed.