TNI Bureau: Home loans and other borrowings will get more expensive as the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) today hiked the repo rate by 25 basis points to 6.50 per cent.

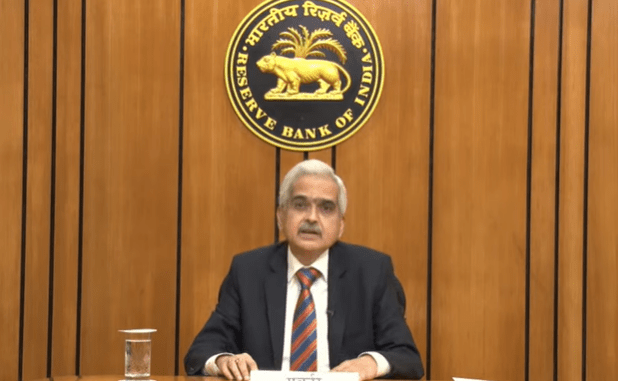

RBI Governor Shaktikanta Das made the announcement after the MPC passed the decision by a majority of 4 members of 6 members.

With the hike of the repo rate, almost all the floating rate loans will increase for sure as they are linked to the RBI’s repo rate, which is the rate at which it lends to banks.

Support Independent Journalism? Keep us live.

This was the first Monetary Policy Statement of the year. The repo rate was raised by 0.35 percentage points to 6.25% in December 2022. There was no change in the reverse repo rate of 3.35%.

With the hike of the repo rate by 25, the real Gross domestic product (GDP) growth for 2023-24 financial year is projected at 6.4% with Q1 at 7.8%, Q2 at 6.2%, Q3 at 6% & Q4 at 5.8%.

Inflation is projected at 6.5% for the current financial year 2022-23. On the assumption of a normal monsoon, CPI inflation is projected at 5.3% for 2023-24, says the RBI Governor.

Comments are closed.